What banks and credit unions need to know about overdraft fees

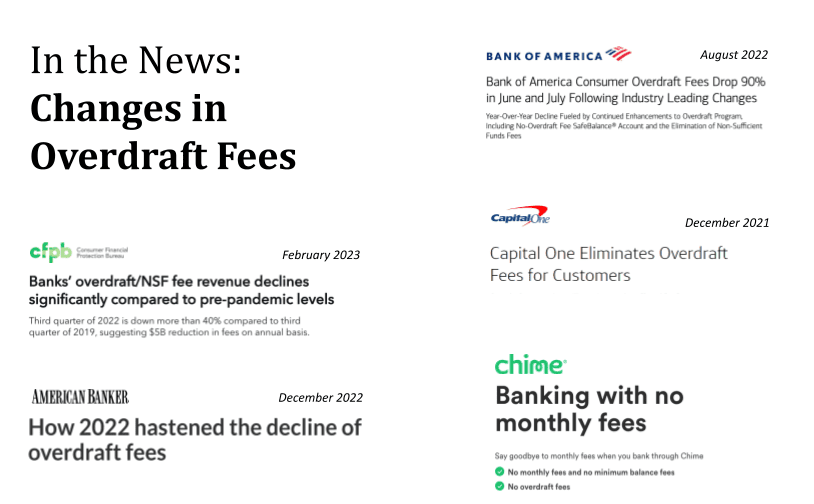

Revenue coming from overdraft and non-sufficient funds fees for U.S. financial institutions (FIs) was 33% lower over the first three quarters of 2022 compared to the same timeframe in 2019, according to research by the Consumer Financial Protection Bureau (CFPB). This downward trend, being driven by increased regulatory scrutiny and competitive pressures, is expected to continue as the White House and CFPB press banks to reduce or eliminate overdraft fees.

‘Junk fees’ in the crosshairs

Most recently, the Federal Deposit Insurance Corporation (FDIC) issued supervisory guidance to ensure that all FDIC-supervised institutions are aware of the consumer compliance risks associated with charging an overdraft fee on a transaction that was authorized against a positive balance but settled against a negative balance, a practice commonly referred to as “Authorize Positive, Settle Negative” (APSN). The FDIC encourages its supervised institutions to review their practices regarding the charging of overdraft fees on APSN transactions to ensure customers and members are not charged overdraft fees for transactions consumers may not anticipate.

The FDIC guidance comes on the heels of the White House releasing this guide for state policymakers on how to take action against what it has labeled “junk fees”—a broad category of business fees that includes fees banks charge for services such as overdraft protection.

As the industry shifts in response to changes in regulation, the pressure for regional and community financial institutions (RCFIs) to reduce or eliminate overdraft fees grows. Many large FIs, such as JPMorgan, Wells Fargo and Bank of America, as well as some larger regional banks, have already moved to address the proposed new rules.

Neobanks that offer banking services through mobile and digital channels are targeting RCFI account holders with consumer-friendly policies such as early access to funds from direct deposits. Account holders are seeing cushions as high as $200 before charging an overdraft fee.

These competitive forces are setting consumer expectations high. Account holders are shopping for better terms and are willing to go elsewhere if they can’t find what they are looking for at their primary financial institution (PFI). Moreover, they want help. Jennifer White, J.D. Power’s senior head of banking intelligence, said, “Customers are expecting a personalized mix of financial advice, hands-on help with problem resolution, and guidance on how to grow their money.” RCFIs who respond proactively will not only be able to retain their status as PFI but also position themselves to grow the relationship.

Tap data to protect PFI status and drive revenue

To address these market challenges around overdraft fees, RCFIs should look to their data to lead the way.

There are many opportunities to leverage data to enhance customer service and manage risk. For example, taking a proactive approach to helping account holders avoid fees by using data to understand an account holder’s overall financial health. This can be accomplished by monitoring transaction data and identifying patterns that may indicate potential overdrafts. The RCFI can then take steps to prevent fees from being assessed, such as notifying customers and members when their balance falls below a certain threshold or offering alternative payment options to avoid overdraft fees. These anti-fee measures are highly sought-after features by account holders and go a long way toward maintaining and strengthening the PFI relationship.

“Anti-fee measures are highly sought-after elements in personalization, with 46% of respondents saying they want banks to help them avoid fees and 37% expressing interest in receiving alerts for their own accounts.” According to an Insider Intelligence consumer survey.

Beyond improving customer service, RCFIs should also make it a priority to identify new revenue sources to offset any losses from changes in overdraft fee regulations. Analyzing the first-party data within the FIs ecosystem can help identify revenue and cost-savings opportunities by providing insight around channel and product utilization, held-away accounts, merchant spend, and engagement with third-party services like Buy Now Pay Later (BNPL), investments and cryptocurrency.

Analyze this data to identify audiences for targeting product promotion, messaging relevance and financial wellness. A real-world example would be an RCFI identifying all the users in their system who are making an auto loan payment to competitive institutions, then developing a campaign targeting those account holders with relevant messaging to bring that loan revenue in-house, further protecting the PFI status and positively impacting the bottom line.

Position your FI for success

While RCFIs can’t predict what will come with future legislation surrounding overdraft fees, those who stay informed on the latest regulation changes and take a proactive approach by using data to institute anti-fee measures and capitalize on new revenue sources will be best positioned to successfully navigate the ever-changing environment of overdraft fees.

For more information on how to leverage data to better serve account holders and drive ROI, visit Data and Marketing Solutions.

FURTHER RESOURCES:

- Research by the Consumer Financial Protection Bureau (CFPB)

- White House guide for state policymakers

- President Joe Biden’s February State of the Union address

- Stats about consumer expectations around this topic.

- What’s happening across the industry

- Insider Intelligence, 2022

- Overdraft Fees Are Getting a Much-Needed Overhaul | Bank Director

- 2022 FinHealth Spend Report Marks First-Ever Decline in Ten Year History of Tracking Fees and Interest Paid for Everyday Financial Services — Financial Health Network (finhealthnetwork.org)

- Amid Overdraft Fee Debate, Ally Bank Steps Forward (cnbc.com)

- Banks and Credit Unions That Have Eliminated Overdraft Fees (businessinsider.com)

- Overdraft Protection | American Bankers Association (aba.com)

- White House pushes state policymakers to restrict ‘junk fees’ | ABA Banking Journal

- More banks cut overdraft fees as pressure builds | S&P Global Market Intelligence (spglobal.com)

- Co:lab breakout session “The Alkami Data and Insight Evolution”

- Consumer Financial Protection Bureau Launches Initiative to Save Americans Billions in Junk Fees | Consumer Financial Protection Bureau (consumerfinance.gov)

- Biden administration moves to curb credit card late fees (msn.com)

- cfpb_overdraft-call_report_2021-12.pdf (consumerfinance.gov)

- Overdraft and NSF Fees Continue to Draw the Ire of Regulators as the CFPB Escalates its Scrutiny of So-Called “Junk Fees” – Banking Exchange

- Supervisory Highlights Junk Fees Special Edition, Issue 29, Winter 2023 (consumerfinance.gov)

- Banks’ overdraft/NSF fee revenue declines significantly compared to pre-pandemic levels | Consumer Financial Protection Bureau (consumerfinance.gov)

- CFPB Issues Guidance Around 2 ‘Junk Fees,’ Including ‘Surprise’ Overdraft Fees & Depositor Fees / Fresh Today / CUToday.info – CU Today

- U.S. Retail Banks Struggle to Differentiate, Deliver Meaningful Customer Experience as Economy Sours, J.D. Power Finds.

Business Banking Solutions

Business Banking Solutions Data & Marketing Solutions

Data & Marketing Solutions Treasury Management Solutions

Treasury Management Solutions Who We Serve

Who We Serve