Consumers are presented with many options for managing their finances – from traditional financial institutions to neobanks and alternative banking solutions. Competitors are no longer the institution down the street, instead they are the endless financial services providers accessible within the application (app) store. As each financial services organization attempts to grow its share of wallet, banks and credit unions need innovative strategies that uncover account holders who hold competitive mortgage relationships. Digital banking solutions can offer a powerful way to connect with these homeowners by delivering personalized data insights that they would otherwise have to turn to third-party sites, like Zillow or Redfin, to track their property value. Regardless of which institution holds the mortgage, your financial institution can offer a comprehensive financial picture that captures all of their assets, while positioning your digital banking solution as a center for engagement and priming account holders for targeted offers.

Powered by Alkami’s partnership with Chimney, banks and credit unions can reimagine the banking experience for homeowners by tapping into property data and home value tracking within their digital banking solutions.

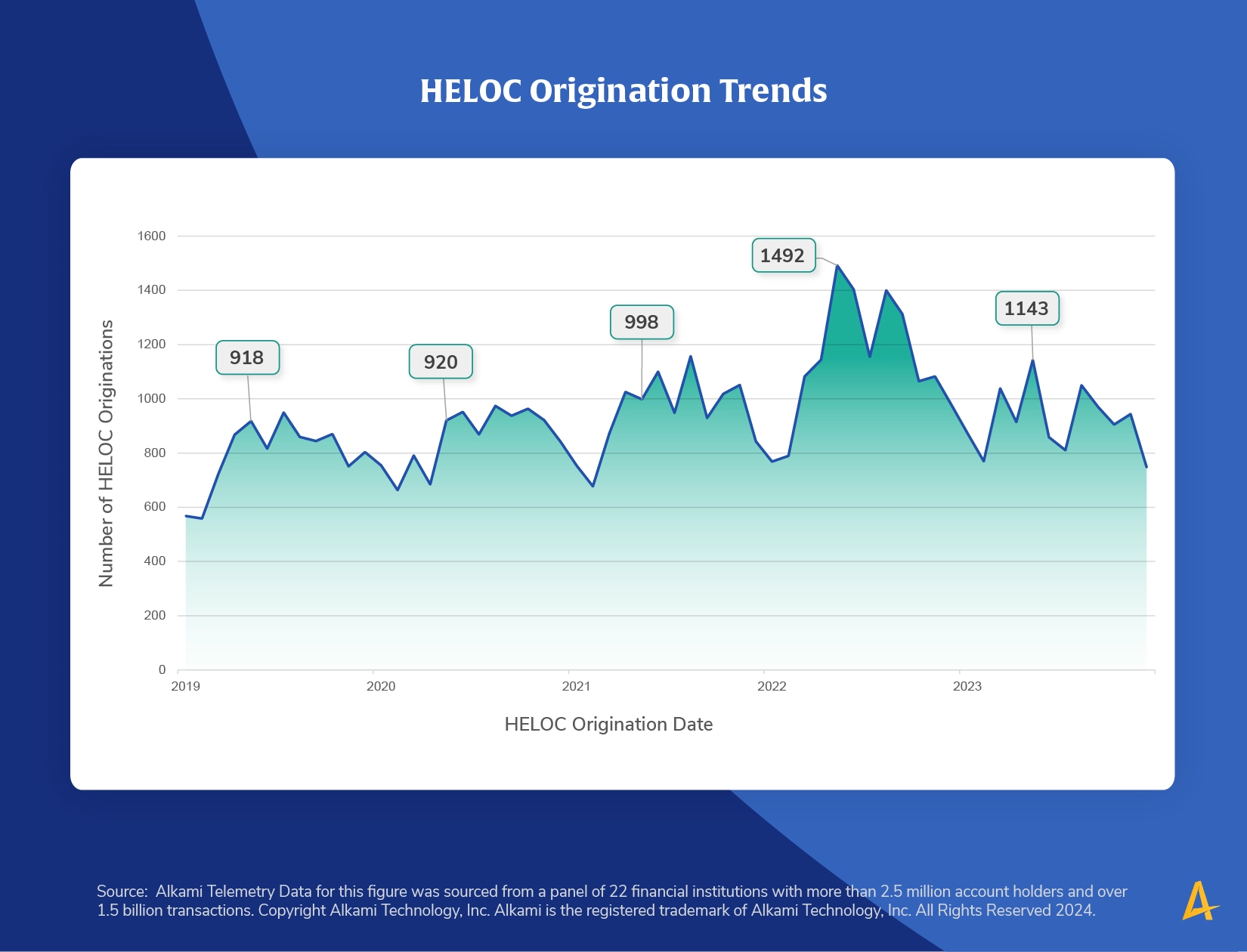

Home equity line of credit (HELOC) adoption has been on the rise, with recent data showing a significant uptick over the past five years. This trend isn’t just a fleeting interest—consumers are increasingly recognizing the value of leveraging their home equity for various financial needs, such as home improvements, debt consolidation, and even funding major life events. In fact, according to data shared by Alkami, HELOC originations have increased by 24.2% from 2020 to 2023.

Consumers are particularly drawn to HELOCs because they offer flexibility and control over how and when funds are used. Unlike traditional loans, HELOCs allow homeowners to borrow only what they need, when they need it, and only pay interest on the amount borrowed. This level of financial flexibility is especially appealing in today’s uncertain economic climate.

To make up for the drop in mortgage origination rates – 72.5% from 2020 to 2023 to be exact – financial institutions should tap in to their data to identify which account holders would be the best candidates for a HELOC (State of the Industry: The 2024 Alkami Telemetry Data Report, 2024). What’s that saying? Strike while the iron is hot. Well, it’s hot. According to State of the Industry: The 2024 Alkami Telemetry Data Report, “sixty-seven percent of digital banking Americans say the rising interest rate environment has had a significant impact on their standard of living and 59% are living paycheck to paycheck.” Consumers – whether they’re renters or homeowners – are looking for support from their financial institution to survive amid high interest rates and rising cost of living.

Direct FCU leveraged these consumer preferences by integrating Chimney’s home value tracking to deliver personalized home equity insights directly into Alkami’s digital banking solution. By providing homeowners with real-time updates on their home’s value and available equity, they not only increased engagement but also drove a significant rise in HELOC adoption. Account holders were not just passively browsing their accounts—they were actively exploring how they could benefit from their home’s equity.

In the first six months after launching Chimney, average monthly HELOC volume increased by 40%.

This highlights the importance of differentiating your digital banking solutions to deliver targeted, relevant content that meets the specific needs of account holders, wherever they are in their financial journey. By offering personalized insights and easy access to HELOC information, Direct Federal positioned itself as a trusted financial partner, ultimately increasing their share of wallet among existing account holders.

To replicate this success, your financial institution can use advanced data analytics within your digital banking solutions to identify account holders with competitive mortgages. Once identified, automate marketing efforts to these account holders and deliver personalized messages and insights about their home’s value and available equity.

To prove to your account holders that you really understand their needs and can support them in their journey, financial institutions must learn how to master personalized banking. Account holders who receive personalized insights are more likely to engage with new financial products, such as HELOCs. Per the 2024 Generational Trends in Digital Banking Study, the data revealed that millennials (ages 28-44) (65%) are significantly more likely than Generation Z (ages 22-27) (47%) and baby boomers (ages 59-65) (46%) to say that relevant product recommendations are very important or important when it comes to their digital banking experience. This personalized approach ensures that your messaging is not just another generic offer but a tailored solution that speaks directly to their financial goals.

Armed with these insights, your financial institution can craft highly targeted HELOC offers that resonate with homeowners. For instance, after providing an account holder with an update on their home’s value, your team could position an article in your digital banking solution’s content management system educating the user on the benefits of a HELOC—highlighting how they could use their equity to renovate their home, consolidate high-interest debt, or even invest in their childrens’ education.

This strategy aligns perfectly with current consumer preferences, as more homeowners look to leverage their equity for specific financial goals. By offering these tailored solutions, your financial institution can position itself as the go-to partner for all their financial needs, increasing both product adoption and long-term loyalty.

Direct Federal Credit Union’s success demonstrates the impact that personalized, data-driven digital banking solutions can have on product adoption and engagement. Don’t miss out on the opportunity to connect with homeowners holding competitive mortgages—reach out, provide them with valuable home equity insights, and show them how they can benefit from a HELOC.

The rise in HELOC adoption, combined with the ability to offer personalized insights and targeted offers, presents a powerful opportunity for financial institutions to differentiate themselves in a crowded market. By leveraging digital banking solutions, you can not only meet but exceed the expectations of today’s homeowners.

Learn how your financial institution can deliver personalized insights, engage homeowners, and grow your share of wallet with home value tracking embedded within your digital banking solution.